Bitcoin (

BTC

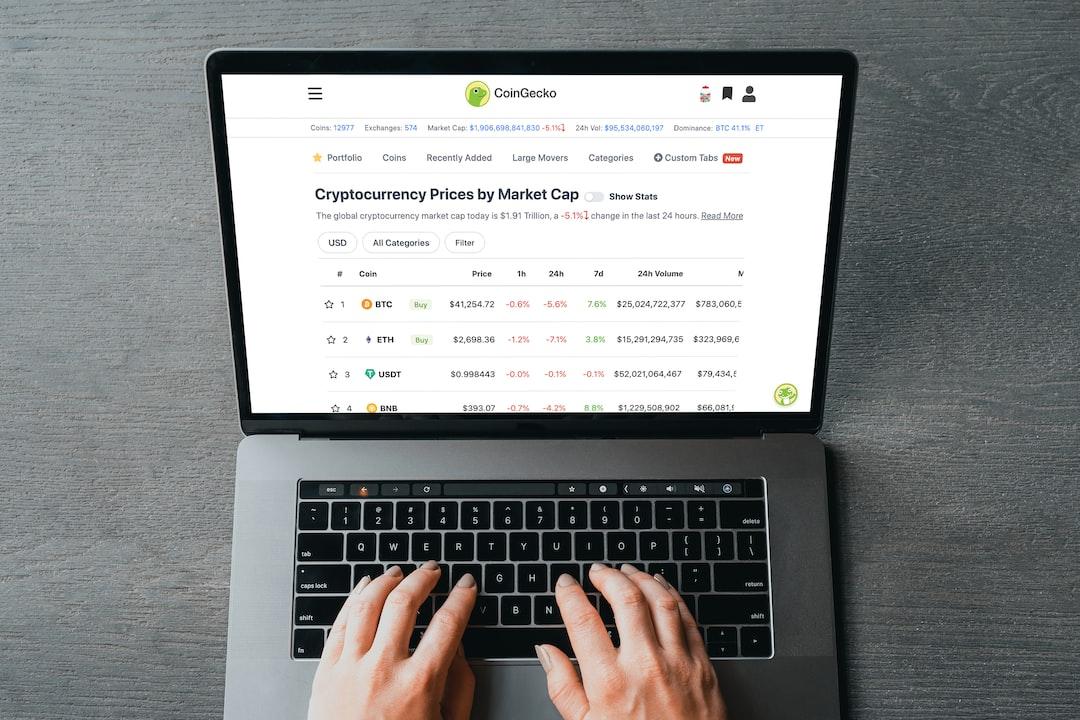

) is on track to reach $50,000 by the time of next year’s block subsidy halving event, according to longtime analyst Filbfilb. In an interview with Cointelegraph, the co-founder of trading suite DecenTrader shared his thoughts on BTC price action. Filbfilb believes that Bitcoin has successfully broken out of its previous trading range below $30,000, which characterized the market for most of 2023. He suggests that the 20, 50, 100, and 200-week simple moving averages, which are currently around $30,000, indicate buying interest and a trend change from the two-year bear market. While a drawdown could occur before the halving, Filbfilb remains bullish and predicts a target just below $50,000. He also believes that a Bitcoin exchange-traded fund (ETF) is inevitable but expects further delays. As for the BTC price chart, Filbfilb identifies $26,000 and $27,000 as important points of control, with resistance levels at $38,000-$41,000. He expects some price appreciation in Q4 but anticipates a potential pullback in Q1 2024 before another run-up to the halving. A Fibonacci retracement of the bear market at $46,000-$48,000 could be a reasonable target assumption from a bullish perspective. It is important to note that this article does not provide investment advice and readers should conduct their own research before making any decisions.

DecenTrader’s Filbfilb deems $48K as a ‘reasonable’ target for BTC price

No Comments2 Mins Read

Related Posts

Add A Comment