Hong Kong’s spot Bitcoin exchange-traded funds (ETFs) are lagging behind their U.S. counterparts in terms of performance since their launch. Data collected by Farside Investors reveals that the three spot Bitcoin ETFs that debuted in the East Asian city on April 30 have amassed a total of $262 million in assets under management (AUM), with the majority of funds being subscribed to prior to listing. However, in their first week of operation, these ETFs attracted less than $14 million in asset inflows, a significant contrast to the billions that flowed into U.S. spot Bitcoin ETFs back in January.

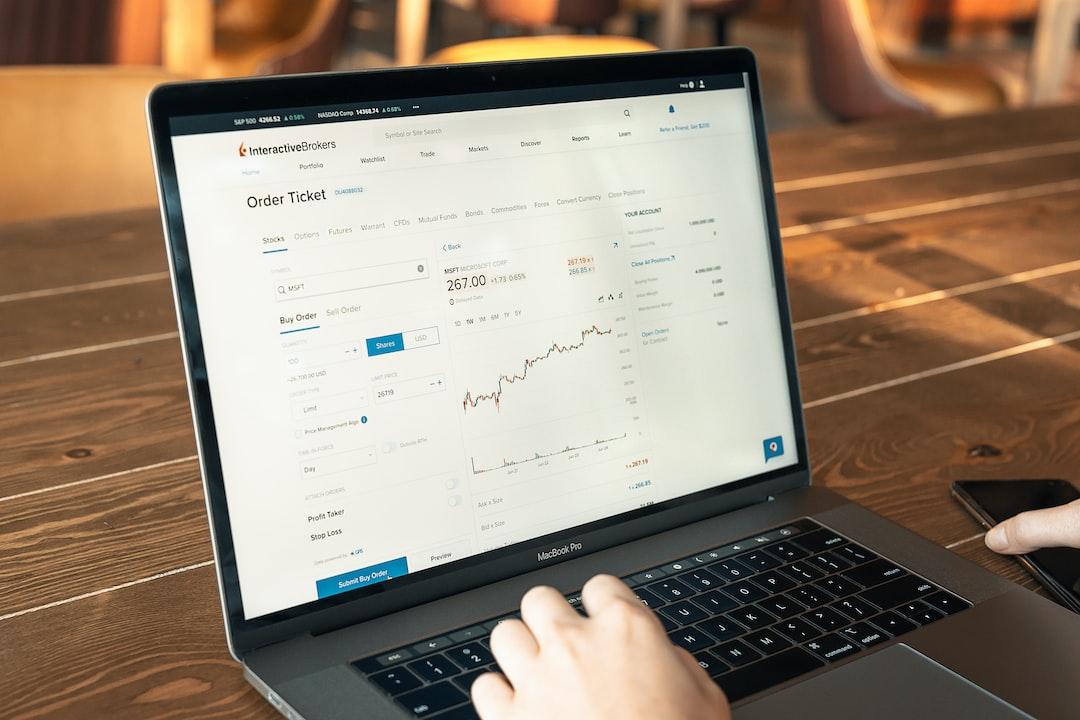

Hong Kong’s crypto ETFs have only managed to attract a fraction of the assets compared to those in the U.S. Source: Farside

Farside Investors commented on the situation, stating, “In our view, the launch of the Bitcoin and Ethereum ETFs in Hong Kong is a far less significant moment than the U.S. ETFs.” Similarly, the first-ever spot Ether ETFs in the world, also based in Hong Kong, failed to make a strong impression, accumulating a total of $54.2 million in AUM and $9.3 million in inflows as of May 6.

The Hong Kong spot crypto ETFs were initially seen as significant advancements compared to their U.S. counterparts. They are denominated in three fiat currencies and offer in-kind transfers, allowing investors to directly purchase and redeem ETF units using Bitcoin or Ether.

Senior Bloomberg ETF analyst Eric Balchunas shared his thoughts on the matter, stating, “[A]s we advised, don’t expect big numbers in HK vs the US, but… the HK ETFs at $310m is equal to $50b in the US market. So in that regard, these ETFs are already as big as their local market as US ones are to theirs.”

The Hong Kong equities sector is relatively small, with a total market cap of $4.5 trillion compared to the $50 trillion worth of listed equities across all U.S. exchanges. Additionally, the Hong Kong equities sector is more illiquid due to slower economic growth in mainland China since 2022.

A recent study conducted by crypto exchange OSL found that nearly 80% of crypto-savvy investors in Hong Kong have plans to invest in the new spot Bitcoin and Ether ETFs. However, these assets are currently inaccessible to mainland Chinese investors unless they possess Hong Kong residency. Researchers at SoSoValue commented on this, stating, “Mainland Chinese RMB investors are not allowed to purchase, and incremental funds may be limited, resulting in low transaction volume.”

SoSoValue researchers also highlighted that after an initial teaser fee period, the management fees of Hong Kong crypto ETFs range from 0.85% to 1.99% annually, significantly higher than the 0.25% average annual management fees charged by U.S. issuers. “Due to the fee difference, for institutional investors who are optimistic about the crypto market and want to hold it for a long time, the holding cost of the U.S. Bitcoin ETF is lower,” SoSoValue explained.

Related:

Hong Kong Bitcoin, Ether ETFs attract over $200M on day 1

Efforts to gain popularity for Bitcoin and Ether ETFs face challenges in Hong Kong

No Comments3 Mins Read

Related Posts

Add A Comment