Bitcoin, Ether, and the wider altcoin market took a hit following better-than-expected United States employment data on June 7. Despite this, traders remain optimistic that this is just a temporary setback before the upward trend resumes.

On June 7, renowned crypto trader il Capo of Crypto shared with their 848,000 followers that there was a “strong sell-off into support” and that altcoins were hit harder. They suggested that this was just a “shakeout,” a phenomenon where a large number of investors sell off simultaneously due to market or economic uncertainties.

The U.S. Employment Situation Summary Report on the same day revealed a surprising increase in jobs, contrary to predictions by crypto analysts. They had anticipated that a weaker employment report would prompt a decision to lower inflation, leading to new highs for Bitcoin.

Markus Thielen, head of Research at 10x Research, mentioned on June 5 that a weaker employment report could result in rate cuts and potentially push Bitcoin to new all-time highs if the CPI inflation report stays at 3.3% or lower.

Despite the unexpected data, Thielen doesn’t attribute the crypto market drop directly to the employment report. He noted that the market sold off without a clear catalyst, describing the data as “mixed.”

Traders are now monitoring key support levels closely following the increase of 272,000 jobs in the U.S. in May, alongside a slight rise in the unemployment rate.

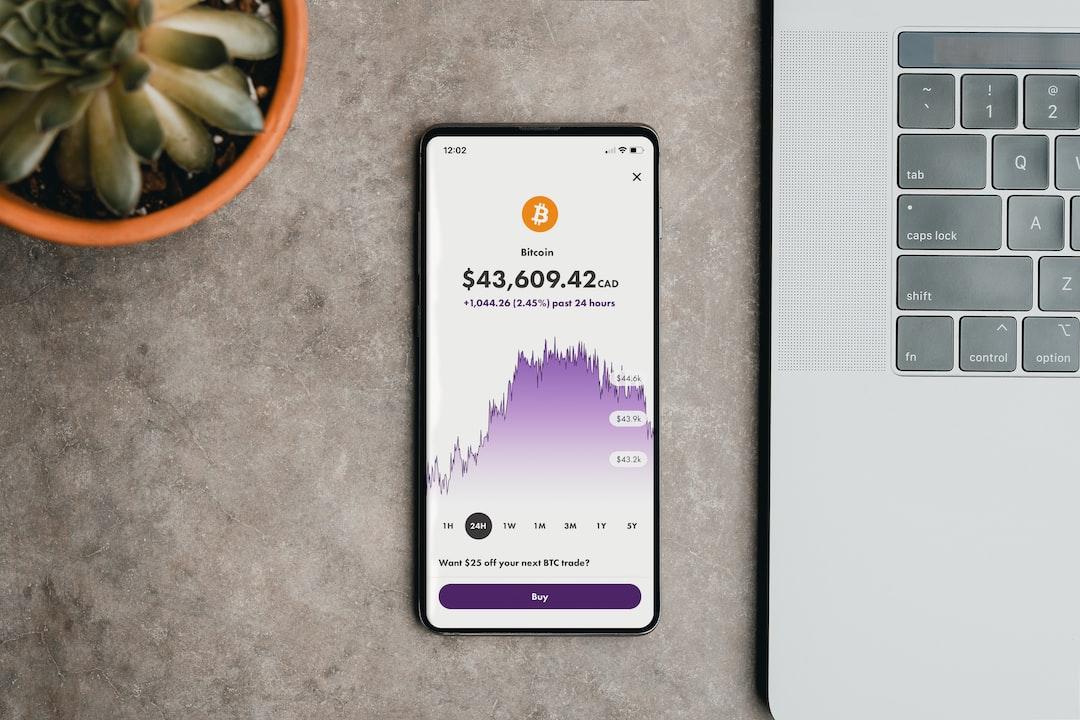

Bitcoin saw a 1.99% decrease in the past 24 hours, settling at $69,410. Ether dropped by 3.22%, while altcoins like Pepe, Solana, and Dogecoin experienced even more significant losses, according to CoinMarketCap data.

Despite the market downturn, some traders see it as a buying opportunity and believe that the real bull market is yet to come.

As the market continues to fluctuate, traders remain optimistic and view the recent dip as a chance to capitalize on potential gains.