Bitcoin (

BTC

) may be on the brink of entering an exciting phase known as the “Banana Zone,” where its price could experience a significant surge. However, crypto analysts suggest that before this happens, three key trends need to reverse.

Describing the current state as “The Boring Zone” before transitioning into the “Banana Zone,” Global Macro Investor (GMI) head of research Julien Bittel shared this perspective in a recent post on June 18.

The term Banana Zone was coined by GMI founder and crypto pioneer Raoul Pal to signify a period of substantial upward price movement. Nonetheless, analysts at CryptoQuant are of the opinion that a sustainable recovery hinges on three crucial indicators making a turnaround.

According to CryptoQuant’s anonymous author, IT Tech, one of these indicators is the reduction of Bitcoin miner selling. This activity has been on the rise ever since mining revenue plummeted by 55%.

Following Bitcoin’s all-time high of $73,679 in March, miners have witnessed a significant decline in revenue. On March 11, daily revenue from block rewards and transaction fees reached approximately $78.89 million, but has since fallen by around 56%, standing at $34.26 million as of June 12, as per Blockchain.com data.

Another important indicator highlighted by the analyst is the need for an increase in stablecoin inflows. With no new issuances in the stablecoin market, liquidity has decreased, impacting price volatility. CryptoQuant data shows a nearly 10% decrease in stablecoins held in crypto exchange reserves over the past two months, currently standing at $21.96 billion.

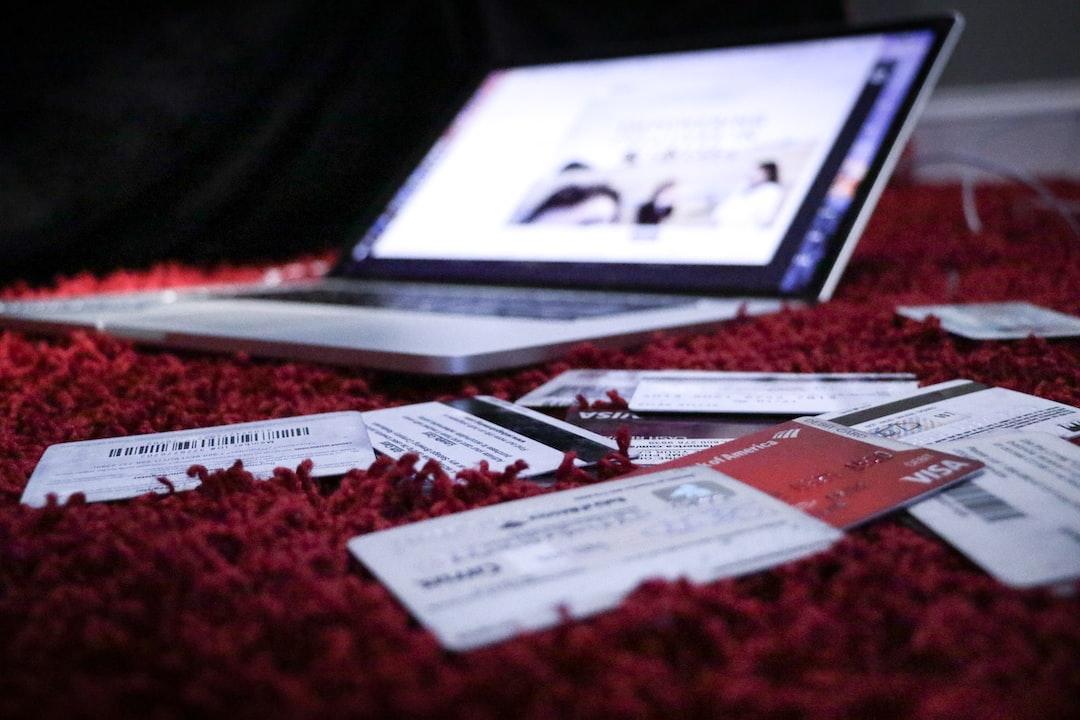

Lastly, the analyst points out that outflows from Bitcoin exchange-traded funds (ETFs) such as Fidelity and Grayscale Investments also need to decrease as they contribute to selling pressure for Bitcoin. On June 18, Fidelity Bitcoin Wise Origin Bitcoin Fund (FBTC) and Grayscale Bitcoin Trust ETF (GBTC) saw outflows of $83.1 million and $62.3 million, respectively, according to Farside data.

Currently trading at $64,966, Bitcoin has seen a 2.35% decrease over the past 30 days and is down 12% from its all-time high in March. IT Tech suggests that this could potentially be a market bottom.

While Bitcoin has been relatively stable, other major altcoins like Solana (

SOL

), Dogecoin (

DOGE

), and Shiba Inu (

SHIB

) have experienced significant declines in the past week.

In conclusion, analysts and traders are keeping a close eye on Bitcoin’s price movement, anticipating a potential shift in the near future. As the market remains dynamic, it is essential for investors to conduct their own research and exercise caution before making any investment decisions.