Bitcoin miners are about to experience a significant change in their rewards as the anticipated event known as “the halving” approaches. This measure, designed to combat inflation, is expected to take place around April 17, 2024.

While this is not the first halving event, the crypto world is entering uncharted territory. The recent record-breaking prices and a crowded mining landscape have added an air of mystery and suspense to what could be one of the most significant days in cryptocurrency history.

Leading up to the halving, the United States approved the first-ever spot Bitcoin exchange-traded funds, and Bitcoin reached an all-time high price of $73,679 on March 13, 2024. It is uncertain whether the price will decrease, skyrocket, or remain stable after the halving in April. However, studying past halving events can provide insights into what might happen this year.

The first halving took place on November 28, 2012, reducing the block reward from 50 BTC to 25 BTC. At that time, BTC was valued at $12.20. Interestingly, if someone had invested $100 in BTC on the day of the first halving and held onto it until March 13, 2024, their investment would have been worth $655,743.

Following the first halving, the price of BTC surged from $12.20 to around $1,000 by the end of 2023. The second halving occurred on July 9, 2016, reducing the block reward to 12.5 BTC. Bitcoin’s value at that time was approximately $640, which rose to $2,550 by July 2017.

The most recent halving event occurred on May 11, 2020, reducing the mining rewards to 6.25 BTC per block. At that time, Bitcoin was traded at around $8,750. Within a year, Bitcoin reached an all-time high of about $62,000.

As the 2024 halving approaches in mid-April, both the price of BTC and speculation surrounding the event have reached new heights. Analysts predict various outcomes, ranging from a price of around $75,000 shortly after the halving to $250,000 or more within a year.

While history suggests that BTC prices tend to surge after halving events, there have been occasional setbacks and downturns in the months following the halving. It is crucial to remember that predictions about market movements are speculative, and the future of Bitcoin’s price remains uncertain after the halving. However, historical trends indicate that all-time highs often follow halving events.

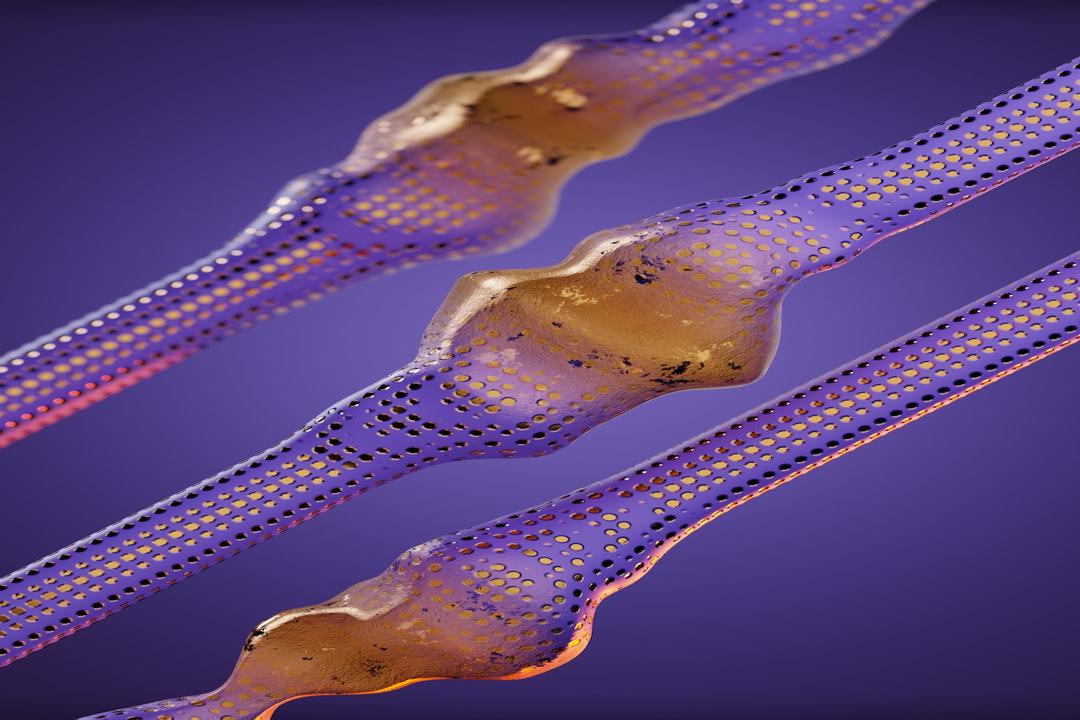

Besides price concerns, there are also unanswered questions about network security in the post-halving world. Some worry that smaller miners may be forced out of the scene due to the 50% reduction in rewards. This could lead to a decrease in hash rates and overall network security. However, previous halving events have had minimal impact on network security, and many analysts anticipate a smooth transition for the Bitcoin network.